Biggest African blockchain stories of 2023, according to Mariblock writers

Explore Africa's blockchain evolution in 2023 through the lenses of Mariblock writers.

The global blockchain ecosystem returned to fundamentals in 2023 after the epic failures of FTX and Terra-Luna plunged the industry into a bear market. 2023 became a pivotal period for rebuilding and emphasizing practical solutions — even more so in Africa. Our reporters have picked stories that best captured this shift in Africa.

Our selected stories reflect the developments that shaped Africa’s blockchain landscape in 2023. From regulatory advancements in Nigeria and Kenya, the integration of crypto payments by Stitch in South Africa to the acquisition of Qala by Btrust (cofounded by Jack Dorsey and Jay Z), and the partnership between TBD and Yellow Card for cross-border payments, each narrative underscores the foundational shifts steering Africa towards a more robust and sustainable blockchain future.

Stay up-to-date with the latest blockchain developments in Africa

Oluwaseun Adeyanju: Regulatory progress in Nigeria and Kenya

I have a love-hate relationship with crypto regulation. On the one hand, I believe it’s necessary for consumer protection. On the other hand, I’m concerned it puts too much power in the hands of regulators, potentially threatening the survival of some crypto’s fundamental ethos. Regardless of my feelings, regulatory developments remain significant. We’ve seen in Nigeria that they make or break businesses and their models.

Two of the most critical regulatory updates continentwide come in the last two months of the year. First, in Kenya, a parliamentary committee asked the local lobby group Blockchain Association of Kenya to draft a crypto bill. The second, perhaps more significant, development came out of Nigeria, where the central bank lifted a three-year ban on crypto transactions within the country’s financial system.

Why it’s a big deal

Topline: One of the rudest awakenings the industry has faced is the reality that crypto needs legacy institutions to go mainstream. The thing with institutions is that they are careful about locking horns with regulators. Spoiler: crypto makes you lock horns with regulators.

- Case in point: When the Central Bank of Nigeria prohibited banks from working with business companies in 2021, the Nigerian crypto industry had to reinvent itself to make peer-to-peer marketplaces the primary on- and off-ramp system to accommodate the loss of institutional partners.

- That directive meant that crypto companies needed to build new distribution channels rather than leverage existing infrastructure. That makes development more expensive in a region that doesn’t have much capital. That tends to make businesses move to friendlier climes.

- We saw that in Kenya last year when a controversial digital asset tax made local crypto companies explore the possibility of setting up their bases in other countries, such as South Africa.

The tilt: The increasingly progressive crypto regulatory landscape in Africa’s largest economies sets the stage for a year of growth across board. For starters, if the impact of the European Union’s Markets in Crypto Assets (MiCA) legislation is anything to go by, Nigeria and potentially Kenya (if it finally publishes a law) are likely to attract the capital needed to grow the ecosystem.

The MiCA effect 🇪🇺🚀

— Patrick Hansen (@paddi_hansen) May 9, 2023

The share of VC investment into European crypto projects is up almost 10x in one year - from a share of 5.9% in Q1 2022 to 47.6% in Q2 2023.

Regulatory clarity attracts capital & entrepreneurs from around the world. Great development for crypto in Europe! pic.twitter.com/kUVp3rwlg3

Eseose Oseghale: Stitch introduces crypto payment option in South Africa

In November, South African payment gateway Stitch became the first traditional fintech company on the continent to integrate crypto payment options. The integration, powered by crypto exchange Valr, includes wide-ranging crypto assets, including bitcoin, ether (Ethereum’s native token), stablecoins, etc.

The development is equivalent to a Flutterwave or Paystack adding cryptocurrency as a payment option in Nigeria.

Why it’s a big deal

Topline: This highlights the importance of regulatory clarity for the institutional adoption of cryptocurrency. Since 2022, financial regulators in South Africa have been working to provide regulatory clarity to the crypto industry.

- Traditional payment gateways like Stitch, Flutterwave, Paystack, etc, power most online payments, and these services need to allow crypto to be widely used for payments.

- The challenge, however, is that these fintech companies are regulated and, as a result, are careful to ensure they are always compliant with laws.

- If the regulator says financial institutions aren’t allowed to deal with cryptocurrency, it becomes almost impossible for a payment gateway to support crypto payments.

Case in point: Lazerpay: The crypto payment service Lazerpay shut down in 2023 after struggling to raise capital to keep running.

- Lazerpay founder Emmanuel Njoku told Crypto@Scale the story of events behind the scenes, emphasizing that lack of regulatory clarity was one of the biggest challenges his former company faced.

- He said:

“Think of the biggest payment gateways you know in Africa or Nigeria. We got into the room with the highest person in the organization. The problem was [that the] compliance [department] always shuts it down.

“The regulatory framework around crypto in Nigeria, which was our core market, was not clear at all, and these enterprise businesses don’t want to put their business in harm or at the mercy of the central bank because they wanted to add crypto to their offerings. So that was the problem, and we realized that late.”

- In essence, without regulatory clarity, making cryptocurrencies a payment option at scale would be tough.

- The development also highlights how progressive regulation can be a competitive advantage for countries looking to be at the forefront of Web3 technologies.

Stay up-to-date with the latest blockchain developments in Africa

Sam Adeyemo: Btrust’s acquisition of Bitcoin talent firm Qala

Last September, Btrust, the non-profit founded by Block CEO Jack Dorsey and rapper Jay Z to support the advancement of the Bitcoin protocol in emerging markets, acquired Africa-focused Bitcoin talent firm Qala.

Why it’s a big deal

Topline: There is no shortage of commentaries on how Africa can be the most crucial hub for cryptocurrencies globally. But the problem is that Africa still lags behind the rest of the world for technical talent, one of the industry’s most significant indicators of building activities.

- Africa must balance being a consumer and a builder if it will reach its prophesied potential.

- The problem with little African representation is that protocols, essentially the industry’s bedrock, will be built without factoring in African realities.

Case in point: Femi Longe, the program lead at Btrust Builders, the name Qala adopted after the acquisition, told Mariblock that there is a shortage of African developers actively engaged with Bitcoin.

- Consequently, only a limited number of products tailored to African cultural and economic contexts have been created.

“The problem of [Africans ...] not being in that group [ Bitcoin developers] is decisions can be made around the technology that do not match our own technical reality or our own cultural reality.”

Looking forward: The Qala acquisition, which provides a much-needed capital resource to train more Bitcoin developers, is a step in that direction.

- It also underscores an emerging trend of an increased focus on producing more technical talents across the continent. Talent development projects Web3Bridge and Aya recently received retro funding for their work in the ecosystem.

- 2024 is shaping up to be a year where Africa’s technical quota sees a sizeable leap.

Stay up-to-date with the latest blockchain developments in Africa

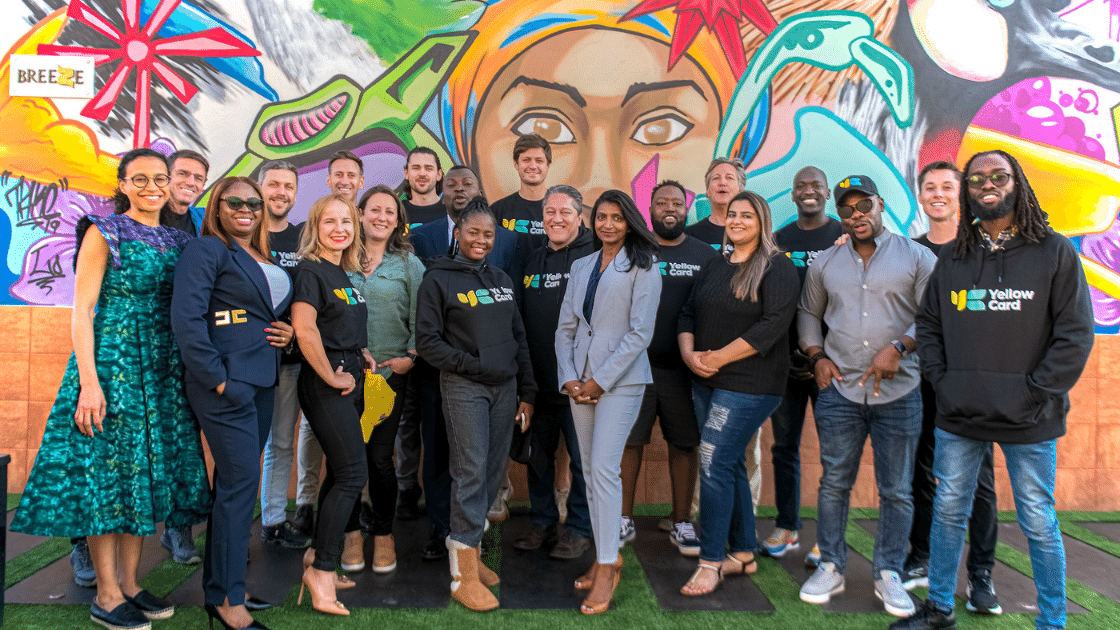

Ogechi Nelson: Yellow Card’s partnership with Cashapp parent company Block

In April 2023, TBD, the web3 software developments arm of Dorsey’s Block Inc., partnered with Yellow Card, the pan-African cryptocurrency exchange, to facilitate cross-border transactions across 16 African countries.

Why it’s a big deal

Topline: Remittance has been one of the most talked-about use cases for cryptocurrency within the African context, mainly because the continent, particularly Sub-Saharan Africa, has perennially been the most expensive region to send money (currently 8% 8.4% on average, according to the World Bank).

- According to the United Nations, Africa received $100 billion in remittances in 2022.

- Still, crypto remittance has remained niche.

- Challenges abound. First, crypto still struggles to gain public trust at scale. Its unfamiliar UX has been unhelpful as well. There have also been regulatory concerns. However, the more significant roadblock is the dearth of institutional interest in crypto-based remittance. The institutions own the distribution channels.

- Yellow Card CEO Chris Maurice shared his view with Mariblock that the sluggish adoption of crypto-based remittance has much to do with the fact that legacy remittance companies, who currently make a lot of money due to the inefficiencies in the market, don’t have the incentives to change the status quo.

The upshot: The Block-Yellow Card partnership arguably represents the highest-profile development relating to crypto-based remittance. Block, a multi-billion-dollar company, built a self-acclaimed compliant crypto remittance infrastructure and launched it in Africa.

- It was a words-put-into-action moment, with CEO Dorsey saying during Block’s Q1 2023 earning call that Global South (where Africa belongs) forms a major part of the company’s current strategy.

- TDB’s remittance infrastructure will be available to other companies as well. 2024 is poised to witness more crypto remittance developments.

Stay up-to-date with the latest blockchain developments in Africa

Adeolu: EchoVC launches an $8 million blockchain fund

In April, Nigerian venture capital firm Echo VC launched an $8 million pilot blockchain seed fund called EchoVC Chain, focusing on business-to-business infrastructure, decentralized finance (DeFi) and market-making solutions.

Why it’s a big deal

Topline: An $8 million blockchain fund launched during the bear market by a traditional venture capital firm could be seen as a form of validation of the potential of blockchain to solve problems on the continent.

- It came at a time when VC funding dried up across most tech verticals.

Telling quote:

- Speaking with Mariblock, Tsendai Chagwedera, principal at EchoVC Partners, explained why the firm launched its blockchain fund after the crypto winter.

“Crypto has sort of gone through this winter [and] is trying to recover. But for us, this technology is still useful. Nothing fundamentally has really changed to show that [it] doesn’t work. The foremost part of our thesis is the underlying technology and how we [can] use it in Africa,” he said.

- Fellow early-stage investor DFS Labs also launched a blockchain fund in partnership with Stellar Development Foundation to support African entrepreneurs building innovative digital payment solutions on the Stellar blockchain.

- In an interview with Mariblock, Joseph Benson-Aruna, a partner at DFS Lab, shared the firm’s belief in the opportunity for crypto to serve a larger slice of the African market and impact everyday people.

Stay up-to-date with the latest blockchain developments in Africa