Welcome to the first edition of State of Digital Assets, Africa. I’m Oluwaseun Adeyanju, Mariblock’s lead editor.

Topline: As a blockchain and digital assets information firm focused on Africa, we frequently encounter significant stories that could be precursors to how the industry might evolve on the continent.

- The State of Digital Assets, Africa newsletter dives into those significant trends to help builders and operators prepare accordingly.

- I’ll go beyond the news to provide contexts that are easy to miss.

Frequency: I’ll be in your inbox with this newsletter once a week — on Sundays.

- So yes, this was supposed to come in yesterday. It didn’t leave the drafts because we needed to iron out some wrinkles. Apologies for that.

I’ve got just the perfect first edition, focused on one big trend.

Big trend: Crypto could be close to finally making a dent in the African remittance industry.

Here we go!

Image by 8photo on Freepik

Topline: You may have seen the news that United States-based Block — the company behind popular payment apps Cash App and Square — patterned with pan-African exchange Yellow Card to facilitate cross-border payments between 16 African countries, including Nigeria, South Africa, and Ghana. Details here.

Of note: This partnership is based on a cross-border payment infrastructure built by another Block subsidiary — TBD. The setup uses bitcoin and stablecoins to make remittances cheaper.

- Yellow Card and TBD tested the service to send money between the U.S., Ghana, Kenya and Nigeria. CEO Chris Maurice told me in an interview that the funds got delivered “in 60 seconds.”

- TBD’s chief operating officer, Emily Chiu, told the American business magazine publisher Fortune that the system was designed to comply with international and national money-transfer rules.

Salient point: Chiu added that the infrastructure would eventually be open to other companies/developers beyond Yellow Card.

According to Maurice, TBD plans to deploy the payment solution across the Block ecosystem of products. Here lies the opportunity.

- Crypto-based cross-border payments could soon be available to Cash App’s 44 million users.

- Notably, the crypto layer is abstracted away from the users. All they’d do is send dollars, and the recipient gets credited in their local currency.

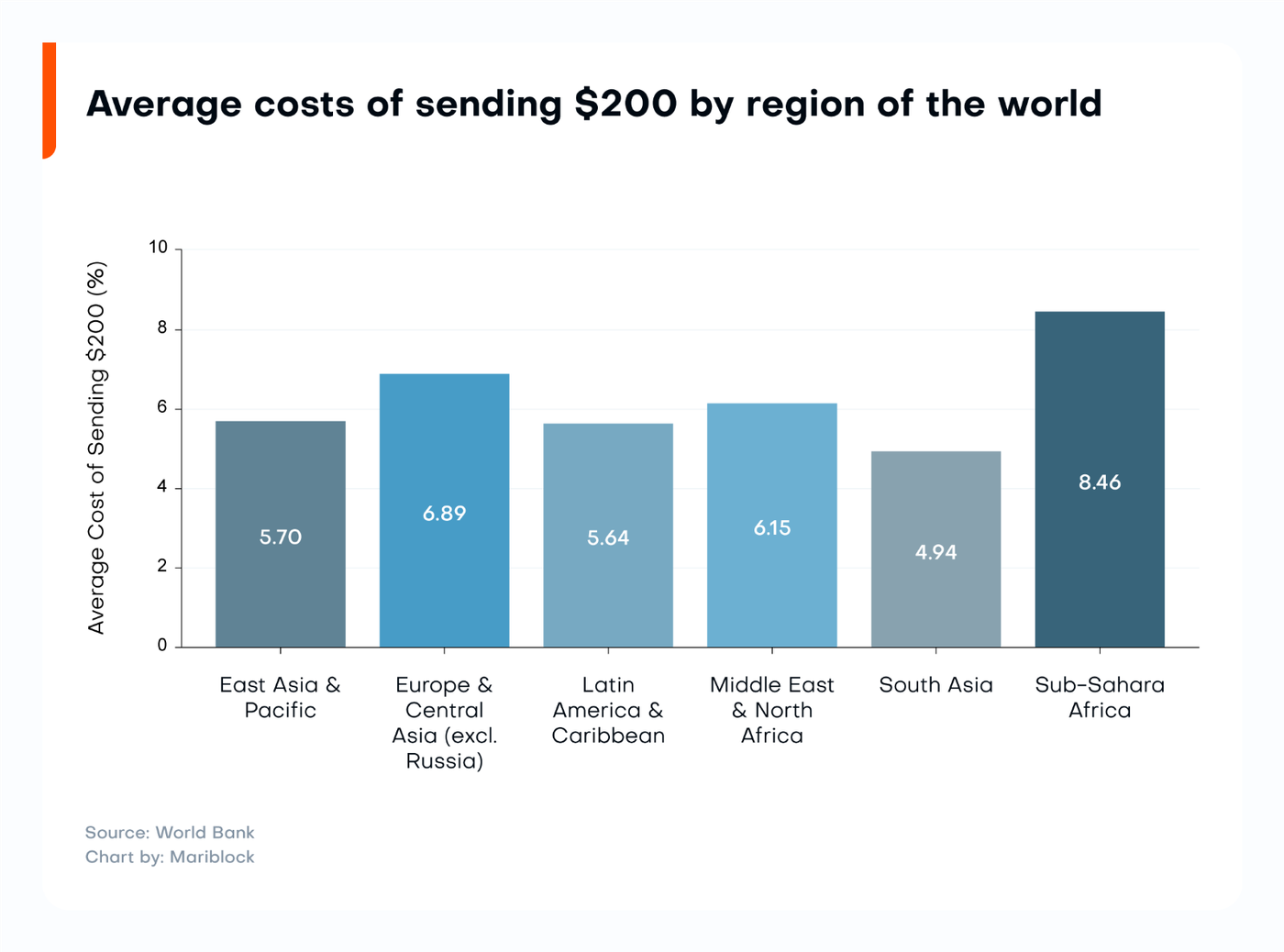

Dive deeper: “Crypto will disrupt several industries and sectors” is up there with the worn-out lines of the past decade. The African remittance market is one of the areas where that narrative frequently springs. And it makes sense because Africa has perennially been the most expensive place to send money worldwide.

- It costs 8.46%, on average, to remit $200 to a Sub-Saharan African country, according to the World Bank’s most recent remittance prices report.

- The bank believes $200 is an “accurate representation of a typical remittance transaction size.”

- By translation, it costs nearly $17 to send $200 to the region.

Mariblock

By comparison: Recent advancements in the crypto space — notably, the Bitcoin Lightning Network and stablecoins — have made it possible to have transaction fees closer to 1% or lower.

- Despite the glaring opportunity, mainstream crypto-based remittances are yet to pick up on the continent.

The problem: Having a great product alone isn’t sufficient to disrupt any industry. The crypto industry continues to learn this truth daily.

- At the minimum, you need a big marketing budget to get the product in front of your target market. And when the product is unconventional, as is crypto, you’ll need to invest heavily in PR to build its reputation.

- Only companies flush with hundreds of millions and billions in cash can do this at scale. None of those companies have shown interest in changing the game.

Traditional remittance companies “make a lot of money ... and so there’s very little incentive for them to change up a very profitable operating business and try to bring these costs down,” Maurice said.

- “It’s going to take a big player in fintech, finance, or the remittance space that’s willing to be the disruptor … willing to say, ‘this entire industry is not going to be the same in five, 10 years, and we want to be a part of that.’ I think Block is [taking] the first step towards that.”

My view: I may be extrapolating this out of proportion, but I do think this could be the development that starts to pave the path toward disruption in Africa’s remittance market.

- Facts: Sub-Saharan Africa received an estimated $45 billion in remittances in 2021.

- Of that, $10.35 billion (or 23%) comes from the United States alone.

- That’s a large enough market to start with.

- Block certainly has the resources (marketing plus customer base) to get up to 10% of that market within three years.

At those numbers, legacy remittance companies will start noticing and realizing that the game is changing. That would leave them with two options.

- Lobby hard to destabilize the emerging competitor — probably using the compliance argument.

- Get onboard and start overhauling the outdated business model.

End note: Legacy remittance companies have been testing the waters with crypto-related partnerships with enterprise blockchain solutions such as Ripple and Stellar.

- In June 2022, MoneyGram linked up with Stellar to facilitate USDC stablecoin remittances in Canada, Kenya, the Philippines, and the U.S.

- Last November, United States-based Ripple partnered with South Africa-based MFS Africa for its On Demand Liquidity product, which, the American company says, helps make remittances cheaper and faster.

I’d love to hear from you.

Do you think Block’s foray into cross-border payments would make a dent?