Africa recorded stablecoin flows equivalent to 6.7% of its GDP in 2024, one of the highest ratios globally.

The figure comes despite the continent’s smaller absolute transaction volumes compared to regions such as North America and Asia, according to a new report from the International Monetary Fund (IMF).

Key IMF findings

- The IMF report, which analyzed $2 trillion in global cryptocurrency transactions in 2024, found that Africa and the Middle East together recorded more than $200 billion in stablecoin activity.

- Tether’s USDT dominated stablecoin use in the region, representing 57.3% of flows, while Circle’s USDC accounted for 42.7%.

- Binance was the leading platform for stablecoin transactions involving Africa, processing 74.3% of the region’s volume. Coinbase, by contrast, handled 25.7%, reflecting Africa’s stronger integration with exchanges serving emerging-market users rather than those catering primarily to advanced economies, the report stated

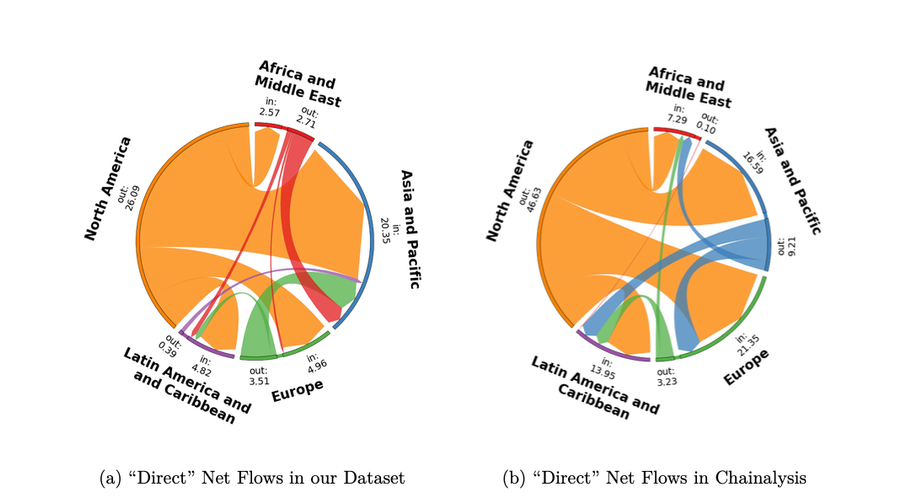

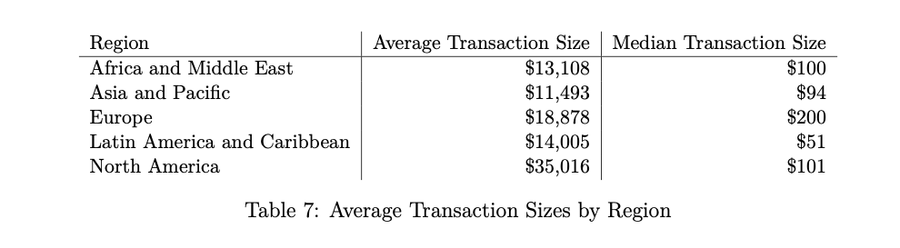

- The average transaction size in Africa and the Middle East was $13,108—smaller than North America’s $35,016 but higher than Asia-Pacific’s $11,493.

- According to the report, only 14% of flows remained within the region; most were cross-border, underscoring the role of stablecoins in remittances and trade payments rather than domestic transactions.

Source: IMF

Why it matters

- The high share of stablecoin flows relative to GDP validates the growing role of crypto in Africa’s cross-border transactions, particularly in remittances and trade.

- This reliance on stablecoins for international transfers, especially in Africa, reflects gaps in traditional banking systems, where costs and delays remain barriers.

Zoom out

- The average transaction size in Africa and the Middle East was $13,108, significantly smaller than North America’s $35,016 but above Asia-Pacific’s $11,493.

Source: IMF

- Globally, the largest stablecoin flows in absolute terms were in Asia-Pacific ($519bn) and North America ($633bn).

- However, emerging markets like Africa and Latin America lead when measured against GDP, signalling outsized adoption relative to economic size.

- USDT is the dominant stablecoin in emerging markets, including Africa and the Middle East, Asia-Pacific, and Latin America and the Caribbean, while USDC is more widely used in advanced economies such as Europe and North America.

- IMF data confirms North America is the primary net exporter of stablecoins, with $54bn in outflows to other regions in 2024, fulfilling part of the global demand for dollars.