IMF flags stablecoin risks, reiterates need for tighter crypto regulation

The international lender of last resort says stablecoin issuance has grown to $300 billion in 2025, but increased adoption poses financial risks if left unchecked.

The international lender of last resort says stablecoin issuance has grown to $300 billion in 2025, but increased adoption poses financial risks if left unchecked.

The bank sees no need to deploy a retail CBDC anytime soon, but it will explore wholesale options.

Adoption is on the rise, but with increased adoption comes financial stability risks that the bank is now looking to counteract.

SARB said the absence of a complete regulatory framework for crypto assets and stablecoins remains a key vulnerability in South Africa’s financial system.

Users can track crypto and fiat balances on one platform and seamlessly move funds between their Luno wallets and fiat accounts.

Dubbed the ZAR Supercoin, the stablecoin designed and developed by New York-listed Super Group, is backed by cash reserves in Absa bank.

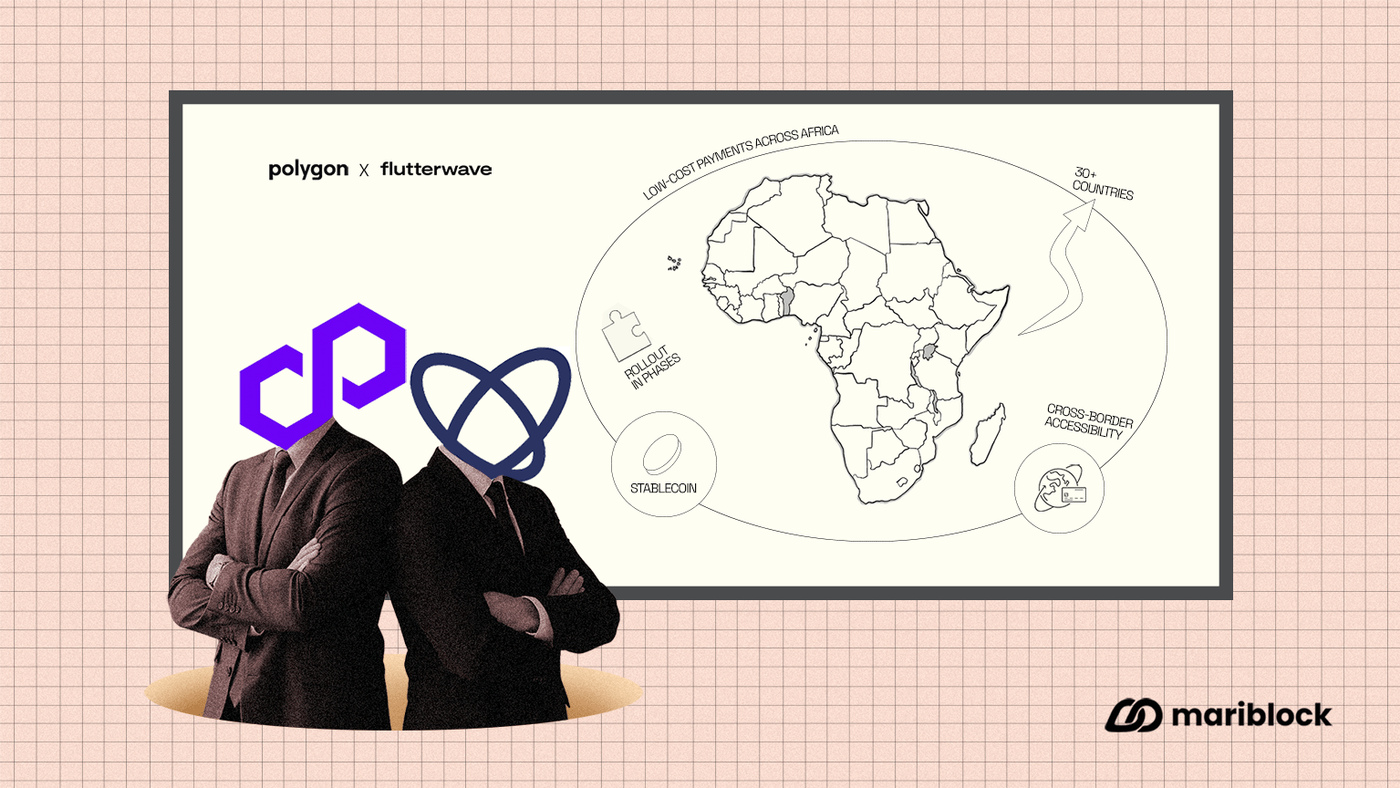

Yellow Card told Mariblock that the decision was driven by strong, growing demand for stablecoin-fiat payment services.

Lesetja Kganyago says he is unconvinced by the supposed stability of USD-pegged stablecoins and believes their backing can be called into question

While the full rollout is scheduled for 2026, a pilot program of the product feature is expected to run its course before the end of the year.