IMF flags stablecoin risks, reiterates need for tighter crypto regulation

The international lender of last resort says stablecoin issuance has grown to $300 billion in 2025, but increased adoption poses financial risks if left unchecked.

The international lender of last resort says stablecoin issuance has grown to $300 billion in 2025, but increased adoption poses financial risks if left unchecked.

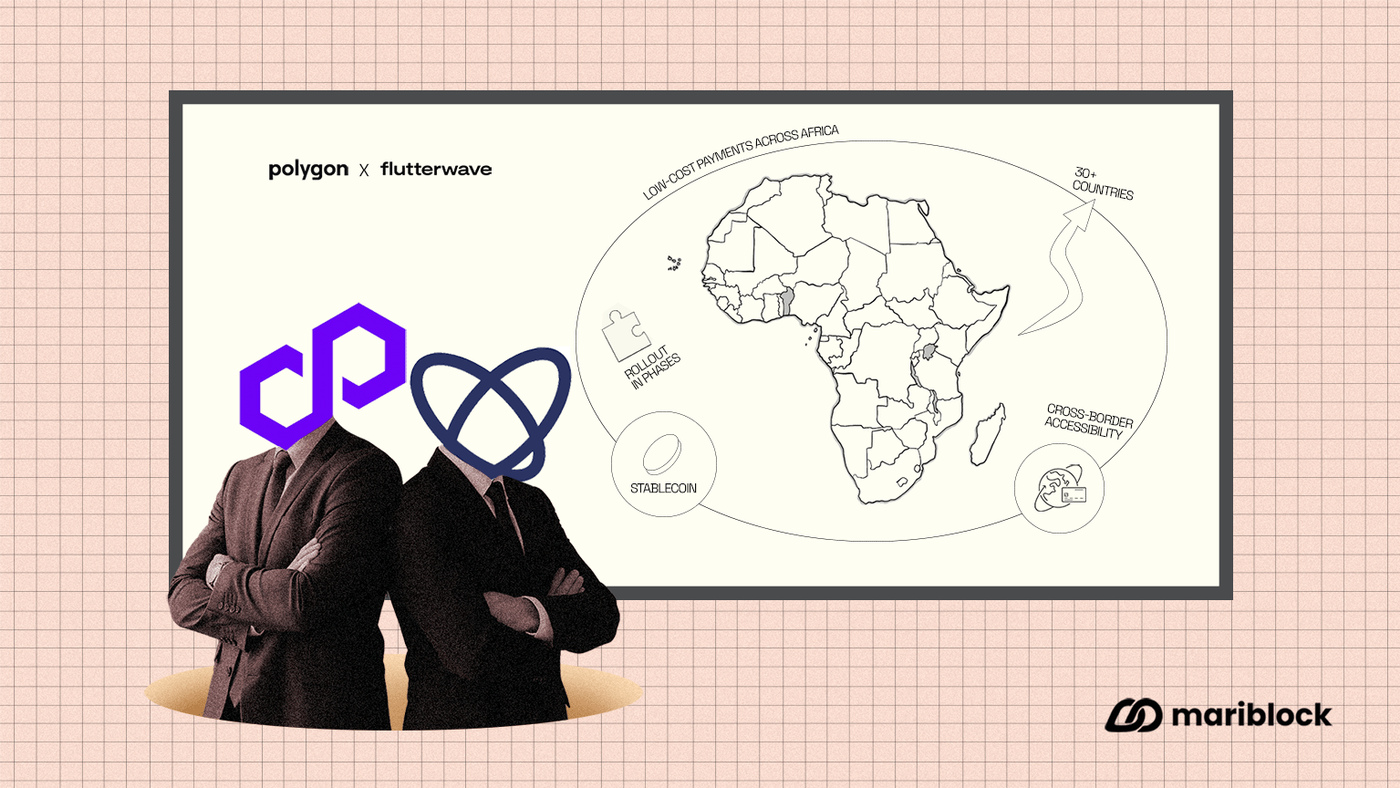

ADAPT, built in partnership with IOTA and the Tony Blair Institute for Global Change, will allow users to settle trades in local currencies and stablecoins.

Yellow Card told Mariblock that the decision was driven by strong, growing demand for stablecoin-fiat payment services.

While the full rollout is scheduled for 2026, a pilot program of the product feature is expected to run its course before the end of the year.

Stakeholders are saying the Act is a step in the right direction, as it provides legal backing to an ecosystem long in the shadows.

Despite these impressive figures, there is a huge policy vacuum sitting between potential and scale.

The bill has scrapped the creation of a new agency, VARA, and has instead placed VASPs under the CMA and CBK’s regulatory oversight.

The digital currency is backed by Ugandan treasury bonds and can be accessed via smartphones.

The network also wants its system to be compatible with more modern digital finance rails such as stablecoins