FTX collapse: A timeline of events as they unfold

Documentation of the events around the failure of the cryptocurrency exchange FTX.

The crypto industry is currently experiencing what industry watchers regard as its most significant meltdown yet — triggered by a liquidity crunch at bankrupt crypto exchange FTX.

It all started with a Nov. 2 story from media outlet Coindesk about a leaked balance sheet that revealed a considerable portion of Alameda’s $14.6 billion was held in FTX tokens (FTT). This raised concerns that potentially unhealthy deals might have been happening between FTX and Alameda behind the scenes. It culminated in FTX filing for Chapter 11 bankruptcy protection in the United States on Nov. 11.

Crypto Africa has put this page together to provide a one-stop spot for tracking the latest developments of this unprecedented event. This page will be updated as new developments emerge.

Nov. 2

- Coindesk’s Ian Allison reported that FTT token — issued by FTX — made up a significant portion (about $5 billion) of Alameda Research’s assets as of June 30, 2022. Both Alameda and FTX are companies founded by Sam Bankman Fried (SBF). [story here]

- Why it matters? FTX had not disclosed that Alameda held such an amount of FTT. This gets murkier, given that SBF founded both companies. The $5 billion worth of FTT tokens on Alameda’s balance sheet at the time of Coindesk’s report represented about 55% to 63% of the total FTT tokens.

- What is FTT? It is a utility token that offers its holders benefits such as tiered trading fee discounts on the FTX exchange platform.

Nov. 6

- In response to Coindesk’s story, Alameda CEO Caroline Ellison tweeted that the leaked balance sheet “is for a subset of [Alameda’s] corporate entities.” [tweet here]

A few notes on the balance sheet info that has been circulating recently:

— Caroline (@carolinecapital) November 6, 2022

- that specific balance sheet is for a subset of our corporate entities, we have > $10b of assets that aren’t reflected there

- Binance CEO Changpeng Zhao, commonly called CZ, disclosed that his company would offload its entire FTT holding, worth at least $580 million, according to on-chain data.

- “Due to recent revelations that have [come] to light, we have decided to liquidate any remaining FTT on our books,” Zhao tweeted. [tweet here]

- Binance received the FTT tokens as part of the proceeds from selling its shares in FTX in 2021. Binance received roughly $2.1 billion in BUSD and FTT. The Zhao-founded exchange initially invested in FTX in 2019.

- Binance was, unsurprisingly, uncomfortable that a firm so closely affiliated with FTX held a significant amount of FTT.

- Zhao also suggested that FTX has been lobbying “against other industry players behind their backs.” [tweet here]

Telling quote

“We gave support before, but we won’t pretend to make love after divorce [referencing Binance’s equity exit from FTX]. We are not against anyone. But we won’t support people who lobby against other industry players behind their backs. Onwards.”

- Binance CEO Changpeng Zhao

- These events flamed up conversations that FTX might be insolvent.

- In a bid to protect the value of FTT, Alameda offered to buy Binance’s entire FTT stash in a private transaction. [Tweet here]

Nov. 7

- Binance CEO Zhao declined Alameda’s offer to buy his company’s FTX tokens. [tweet here]

- Fears of an FTX insolvency coupled with the price crash resulting from Binance potentially dumping such an amount of FTT sent crypto investors into a frenzy.

- FTT holders started selling in droves, crashing the token’s price on their way out.

- FTX exchange also saw what the now-resigned CEO Bankman-Fried would later describe as a “giant withdrawal surge.”

- Bankman-Fried publicly reacted to the reports for the first time.

“A competitor is trying to go after us with false rumors.” Bankman-Fried tweeted. “FTX is fine. Assets are fine.

“FTX has enough to cover all client holdings. We don’t invest client assets (even in treasuries). We have been processing all withdrawals and will continue to be.”

- Bankman-Fried

Nov. 8

- The price of the FTT token continued to drop. It plummeted nearly 29% to $17 between 2:32 PM UTC on Nov. 6 when Zhao tweeted that Binance would sell its FTT holding and 12 PM UTC on Nov. 8.

- The frenzy spread to the broader crypto market, with bitcoin (BTC) and ethereum (ETH) dropping 4.6% and 6.3%, respectively, within 24 hours. [story here]

- Meanwhile, FTX experienced approximately $6 billion of withdrawals in the 72 hours before Nov. 8, according to a Reuters story, citing a message that Bankman-Fried sent to staff. [story here]

- With withdrawal requests showing no signs of ebbing, FTX fell into a liquidity crunch as it couldn’t continue to fulfill customer withdrawal requests. In response, the company paused withdrawals.

“On an average day, we have tens of millions of dollars of net in/outflows. Things were mostly average until this weekend, a few days ago. In the last 72 hours, we’ve had roughly $6 billion of net withdrawals from FTX,” Bankman-Fried wrote, adding that withdrawals at FTX.com, were “effectively paused.”

- Looking to salvage the situation, Binance signed a non-binding agreement to acquire FTX.com (excluding its American unit FTX US). Both Bankman-Fried and Zhao announced the deal on Twitter [hereand here].

- Note: Binance is the world’s largest crypto exchange by trading volume.

Bankman-Fried’s announcement

“Things have come full circle, and FTX.com’s first, and last, investors are the same: we have come to an agreement on a strategic transaction with Binance for FTX.com [pending due diligence].”

Zhao’s announcement

“This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire FTX.com and help cover the liquidity crunch. We will be conducting a full DD in the coming days. … Binance has the discretion to pull out from the deal at any time.”

- FTX token continued to suffer. By the end of the day, the token had crashed roughly 74% since Zhao announced that Binance would sell its FTT stash.

- Before agreeing to sell to Binance, Bankman-Fried asked Wall Street and Silicon Valley billionaires for a $1 billion bailout, according to news outlet Semafor. Sources close to the events told Semafor that the liquidity gap in FTX’s books was as vast as $6 billion. [story here]

- Zhao urged crypto firms to embrace full transparency by publishing Merkle tree proof of reserves. “Binance will start soon,” he wrote. [tweet here]

Nov. 9

- Bloomberg revealed that US regulators — Securities and Exchange Commission and the Commodity Futures Trading Commission — launched an investigation into FTX to find out if the company mishandled customer funds.

- The regulators were also looking into FTX’s relationships with other Bankman-Fried’s affiliated companies. [story here]

- Binance backed out of the deal to acquire FTX.com, following the completion of its due diligence. [full announcement here]

Binance’s announcement

“As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged U.S. agency investigations, we have decided that we will not pursue the potential acquisition of FTX.com.

“In the beginning, our hope was to be able to support FTX’s customers to provide liquidity, but the issues are beyond our control or ability to help.”

- As FTX’s troubles worsen, other leading crypto firms, including Coinbase, Tether (issuer of USDT), Circle (issuer of USDC), Genesis Trading, etc., distanced themselves from any exposure to FTX. [story here]

- The websites of the exchanges venture capital, FTX Ventures and Alameda stopped being assessable. [story here]

- At least nine cryptocurrency exchanges committed to start publishing proof of reserves after Binance CEO Zhao’s urged full transparency. [story here]

- Coindesk published an analysis of how the FTX collapsed using on-chain data. It details how some big withdrawals plunged the exchange into a liquidity crunch [report here]

Nov. 10

- Justin Sun, the founder of the Tron cryptocurrency, tweeted that he and his team were “putting together a solution” with FTX. He didn’t provide the details. [tweet here]

Further to my announcement to stand behind all Tron token (#TRX, #BTT, #JST, #SUN, #HT) holders on #FTX, we are putting together a solution together with #FTX to initiate a pathway forward. @FTX_Official

— H.E. Justin Sun🌞🇬🇩🇩🇲🔥 (@justinsuntron) November 10, 2022

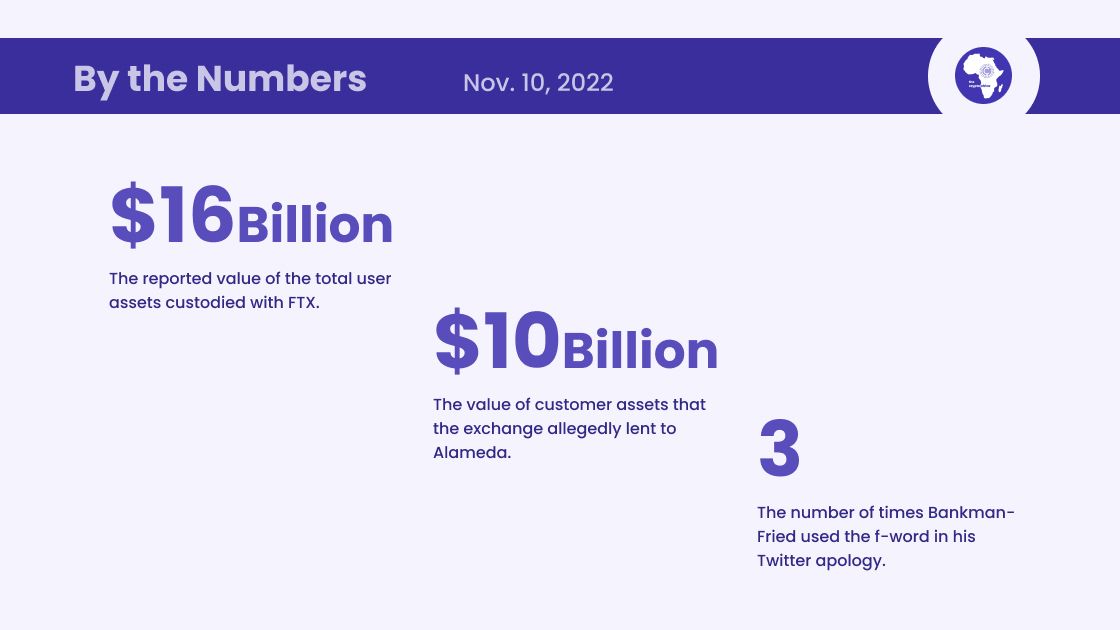

- Bankman-Fried took to Twitter to apologize, while also providing some details of how FTX fell into a liquidity crunch. [tweet here; Coindesk’s reporting here]

- “I’m sorry,” he wrote “I fucked up, and should have done better.”

- He promised that FTX would embrace “radical transparency” if the exchange makes it through the storm. He didn’t supply details on how bad the liquidity shortfalls are.

- In addition, Bankman-Fried assured American users that FTX US is “fine.”

1) I'm sorry. That's the biggest thing.

— SBF (@SBF_FTX) November 10, 2022

I fucked up, and should have done better.

- Citing sources close to the events, Reuters, however, reported that Bankman-Fried used $4 billion in FTX funds to prop up Alameda after the trading firm suffered losses from some deals. [story here]

- According to the sources, other FTX executives were unaware of Bankman-Fried’s alleged misappropriation of funds.

- New reports suggest that the issues cut deeper. The Wall Street Journal published a report that Bankman-Fried lent about $10 billion worth of customer assists to finance risky bets by Alameda Research. [story here]

- The report puts the value of the total customer assets with FTX at $16 billion. In essence, FTX lent more than half in user funds to its sister company Alameda.

- Coindesk pulished a behind-the-scenes report on the people who ran the show at FTX and Alameda. [story here]

- Bahamian regulators froze FTX assets in a move it described as the “prudent course of action” to “preserve assets and stabilize the company.” [press release here]

Nov. 11

- FTX (including American entity FTX US) and Alameda research has filed for Chapter 11 bankruptcy in the U.S. as Bankman-Fried resigns as CEO of the embattled exchange [press release here]

- Following the Journal’s report, a new Reuters report also alleged that FTX founder Bankman-Fried secretly transferred $10 billion worth of customer funds to Alameda Research.

- Citing two people familiar with the matter, the Reuters story added that at least $1 billion of the amount loaned to Alameda was missing. [story here]This was the first time that the extent of liquidity crunch at FTX was reported.

- California's Department of Financial Protection and Innovation became the latest regulator to launch an investigation into FTX. [story here]

- Crypto lender BlockFi suspends withdrawal, saying “we are not able to operate business as usual,” given the lack of clarity on the state of things at FTX. The fallen crypto exchange had rescued BlockFi from failing in June with a $250 million loan.

“We, like the rest of the world, found out about this situation through Twitter,” BlockFi wrote in a letter posted to Twitter late Thursday. “We are shocked and dismayed by the news regarding FTX and Alameda.”

— BlockFi (@BlockFi) November 11, 2022

- A number of crypto financiers and professional investors have their funds locked in FTX, the Journal reported. [story here]

- Hedge fund Galois Capital, whose founder was credited with spotting the Luna crash, has half of its assets — worth $100 million — stuck on FTC, the Financial Times reported. [story here]

Nov. 12

- Contrary to Reuters report, two FTX executives were aware that Bankman-Fried lent FTX customer funds to Alameda, the Journal reports. [story here]

- Hours after filing for bankruptcy, the FTX was hacked, with $600 million in assets moved from FTX’s crypto wallets. [reporting here, and here]

Nov. 13

- Crypto exchange Kraken announced that has frozen accounts owned by FTX Group, Alameda Research and their executives. [tweet here]

“Kraken has spoken with law enforcement regarding a handful of accounts owned by the bankrupt FTX Group, Alameda Research and their executives," the U.S.-based crypto exchange tweeted, adding: "Those accounts have been frozen to protect their creditors.”

Kraken has spoken with law enforcement regarding a handful of accounts owned by the bankrupt FTX Group, Alameda Research and their executives. Those accounts have been frozen to protect their creditors.

— Kraken Exchange (@krakenfx) November 13, 2022

Other Kraken clients are not affected. Kraken maintains full reserves.

- CNBC reports that Alameda was trading billions of dollars of FTX customer funds. [story here]

Nov. 14

- Binance CEO Zhao announced that Binance is forming an industry recovery fund to help projects struggling with liquidity as a result of FTX's failure. [tweet here]

To reduce further cascading negative effects of FTX, Binance is forming an industry recovery fund, to help projects who are otherwise strong, but in a liquidity crisis. More details to come soon. In the meantime, please contact Binance Labs if you think you qualify. 1/2

— CZ 🔶 Binance (@cz_binance) November 14, 2022

- Visa has terminated its partnership with bankrupt crypto exchange FTX.

- A Visa spokesperson, in a statement to Reuters, said “the situation with FTX is unfortunate, and we are monitoring developments closely. We have terminated our global agreement with FTX, and their U.S. debit program is being wound down by the issuer.

- The payment giant had announced the partnership with FTX in early October to produce FTX-branded visa debit cards for U.S. clients and was set to roll it out to 40 new countries before the exchange failed. [story here]

- The FTX contagion is spreading to Africa.

- African Web3 startup Nestcoin has disclosed that its funds are stuck with FTX. Seeking to keep things running, the company has now laid off some of its employees. [story here]

An update shared with our investors earlier today on the FTX incident and its impact on @Nestcoin. pic.twitter.com/0Mjo4SYF7R

— YB (25,25) ⏳ (@YeleBademosi) November 14, 2022

- Anti-crypto U.S. congressman reaffirms his crypto stance.

- Congressman Brad Sherman in a statement on the FTX implosion claimed that the exchange supported Democrats with funds disguised as campaign donations to influence crypto regulations. [story here]

“I believe it is important now more than ever that the SEC take decisive action to put an end to the regulatory gray area in which the crypto industry has operated.”

- BlockFi keeps withdrawals paused

- The crypto lending and trading platform told customers on Monday that withdrawals remain paused and asked that no new deposits be made as the company finds its way through the murky waters created by the FTX collapse. [story here]

- The U.S. Attorney’s Office of the Southern District of New York is investigating the circumstances surrounding the sudden collapse of FTX, Bloomberg reports. [story here]

Nov. 15

- The Supreme Court in the Bahamas has assigned two bankruptcy experts from Big Four accounting firm PwC as provisional liquidators to oversee FTX’s assets. [announcement here]

- BlockFi preps for probable bankruptcy as its exposure to FTX threatens survival, reports the Journal. The crypto lender had suspended withdrawal, saying it is “not able to operate business as usual.” [story here]

Nov. 16

- Reuters has published a report that looks into FTX’s financial statements, company messages and letters to investors.

- The report finds that some assets appeared simultaneously on both FTX’s and Alameda’s balance sheets — despite the two companies supposedly operating independently.

- Alameda received made over $400 million in “software royalty” payments from FTX, the report adds. Alameda used the funds to buy the FTT token, a move that reduced the coin’s supply and supposed its price.

- Reuters also found that a Bankman-Fried close aide tampered with FTX’s accounting system to enable the former CEO to transfer customer money from FTX to Alameda. [story here]

- It gets more indicting.

- Alameda allegedly traded some 18 tokens based on insider information, Decrypt reports. [story here]

- And the contagion keeps spreading.

- The Solana Foundation, the non-profit tasked with promoting the adoption of the eponymously-named Solana network, revealed that it had approximately $1 million worth of assets on FTX before the exchange declared bankruptcy.

- Solana coin has lost more than half of its value (53.8%) since the collapse of FTX. [story here,] [here] and [here]

- Bankrupt trading firm Alameda Research moved $2.7 million worth of Serum, FTX and Uniswap tokens into a wallet where it has now amassed over $89 million worth of assets, according to on-chain data. [story here]

- There are investor regrets too.

- Matt Huang, the co-founder of venture capital firm Paradigm feels “deep regret” investing in SBF and FTX. [story here]

- Some hope?

- Messari research analyst Kunal Goel estimates that FTX customers could recover between 40% to 50% of their deposits. [story here]

- Another one from the regulators.

- The Australian Securities and Investments Commission (ASIC) on Wednesday suspended FTX Australia’s financial license after appointing a voluntary administrator to help nearly 30,000 Australians and over 130 Australian companies get their fund back from the now-bankrupt exchange. [story here]

- More investor discomfort.

- Singapore’s state investment fund, Temasek, invested $400 million in FTX (both its international and U.S. units). The fund is now planning to write off between $200 million to $300 million of its investment. [story here]

- More contagion

- The lending arm of the crypto company Genesis Global Capital has temporarily suspended loan redemptions and originators following the implosion of FTX. Genesis disclosed last week that it had about $175 million stuck in its FTX trading account. [story here]

- As a result of the redemption halt at Genesis, American crypto exchange Gemini has warned customers that they might experience delays in withdrawals. Genesis is a provider of Gemini's saving provider [story here]

- Another crypto lender — SALT — had halted customer withdrawals on their platform amidst the FTX saga. [story here]

- More FTX bankruptcy

- The Bahamian arm of embattled exchange FTX has filed for Chapter 15 bankruptcy proceedings in New York, U.S. [story here]

- Legal actions

- Celebrities who promoted embattled crypto exchange FTX, including Tom Brady, Gisele Bündchen, Steph Curry and Larry David, have all been hit with a class action suit. It alleges that the celebrities promoted unregistered securities. [story here]

- U.S. legislators want to hear from Bankman-Fried

- The U.S. House Committee on Financial Services said it would hold a hearing next month on FTX’s collapse and its implications for the broader digital asset industry. The Committee expects to hear from all involved including the CEO of FTX, Sam Bankman-Fried, Alameda Research and Binance. [story here]

- Binance denied allegations that it deliberately sank the now-bankrupt rival FTX. [story here]

Nov. 17

- The Bahamas Securities Commission wants to be in charge of FTX’s liquidation. However, the embattled crypto company wants to keep process in the U.S. [story here]

- NFTs among assets stuck on FTX

- Apart from cryptocurrencies and DeFi tokens, some customers also have their Solana-based NFTs stuck in FTX’s NFT platform. [story here]

- FTX’s New CEO distances firm from SBF

- New FTX CEO John J. Ray III took to Twitter to distance the bankrupt crypto company, FTX, from its ex-CEO’s controversial tweets. [story here]

- Ray, who previously oversaw the $23 billion bankruptcy proceedings of Enron Corp. said:

“As previously announced, Mr. Bankman-Fried resigned on November 11 from [FTX], FTX US, Alameda Research Ltd., and their, directly and indirectly, owned subsidiaries,” Ray’s tweeted statement reads. “Mr. Bankman-Fried has no ongoing role at [FTX], FTX US, or Alameda Research Ltd. and does not speak on their behalf.”

(1/3) Statement from John Ray, Chief Restructuring Officer and CEO of @FTX_Official, regarding Mr. Bankman-Fried’s recent public statements:

— FTX (@FTX_Official) November 16, 2022

- The aftermath of Paused withdrawals

- Gemini suffered a rush of outflows after it paused customers withdrawals a day ago. [story here]

- Crypto lender SALT also had its license suspended for 30 days by California’s Department of Financial Protection and Innovation after it paused client withdrawals and deposits due to FTX exposure. [story here]

- FTX employees are also entangled in the web of losses

- In addition to losing their jobs, FTX employees are likely to lose their life savings as they were encouraged to save in FTX, Coindesk reports. [story here]

- FTX hack

- The hacker behind the $600 million attack of FTX recently converted over $7.4 million worth of BNB tokens into Ether and Binance USD on Thursday. [story here]

Crypto Africa will continue to update this page with the latest developments in the FTX saga.