Crypto promised freedom from institutional trust — a way for people to take control of their money without relying on banks or other intermediaries. Central to that vision was self-custody: the idea that users should hold their assets rather than depend on centralized entities. But the industry has often fallen short of that promise.

FTX’s 2022 collapse exposed how easily insiders can misuse customer funds. And when insiders aren’t the problem, hackers are. In Nigeria, Patricia reported a major 2022 breach that left users stranded. Global exchange Bybit lost $1.5 million in ETH to a security exploit earlier this year.

These incidents have put self-custody back in sharp focus.

Zap Africa, recently in the spotlight due to a trademark dispute with fintech company Paystack, is betting on this shift. Launched in the wake of the FTX fallout, the startup offers non-custodial crypto and fiat swaps, built around user control and transparency. Its co-founders say the goal is to reduce reliance on intermediaries, a practical response to risks Nigerian users know all too well.

“These companies [FTX and Celsius] went insolvent, and a lot of customers lost funds and were forced to go back to square one, Tobi Asu-Johnson, Zap Africa’s co-founder, told Mariblock. “We wanted people to have a platform where they never needed to depend on anyone to be in control over their own funds.”

While Zap isn’t the only company working to restore faith in Nigeria’s crypto infrastructure, it’s taking a distinct approach.

Models of trust: Reducing custodial risk from different angles

Across Africa, platforms like Minipay and Onboard are simplifying self-custody through smart custody, key abstraction, or other intelligent approaches to allowing users to manage their assets safely. Instead of asking users to manage seed phrases, these wallets encrypt key data and back it up to cloud services like Google Drive or iCloud, reducing user error without giving up control.

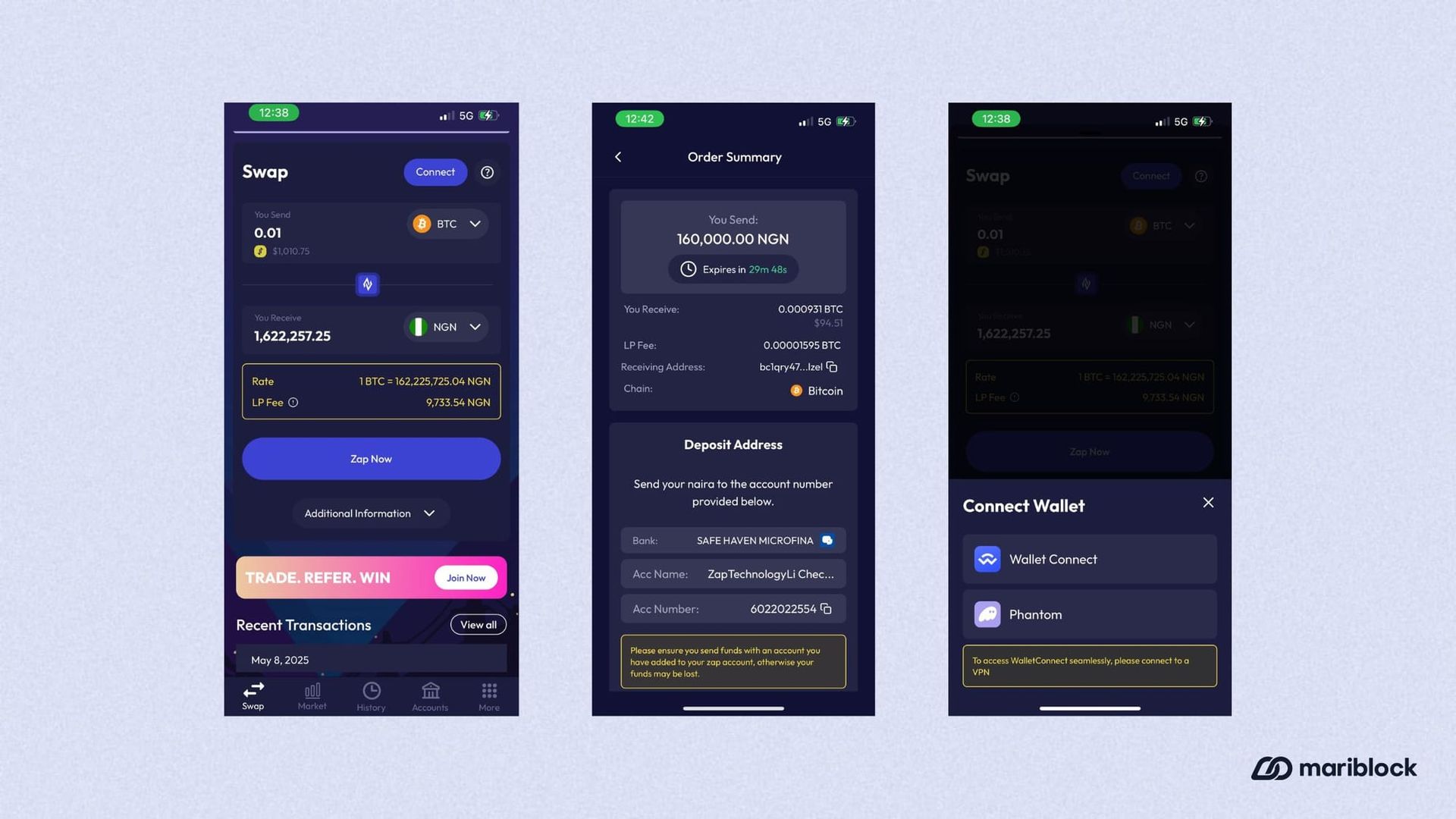

Others, like Zap and NoBlocks, focus on the exchange layer. Zap offers an interface for non-custodial crypto-to-fiat and crypto-to-crypto swaps. NoBlocks, built by peer-to-peer protocol Paycrest, enables fully decentralized fiat trades but doesn’t support crypto-to-crypto swaps. Neither platform holds user funds beyond what’s needed to complete a transaction.

These models reflect a growing shift toward trust-minimized infrastructure. Between July 2023 and June 2024, Nigeria ranked second globally in overall decentralized finance (DeFi) value received, according to Chainalysis. While these tools aren’t DeFi protocols, they align with the movement, each reducing custodial risk without sacrificing usability.

Mariblock

How Zap Africa works

In addition to crypto swaps, Zap supports fiat payouts by letting users specify a bank account to receive naira and providing a wallet address to send the equivalent amount of crypto.

While Zap’s bring-your-own-wallet model stays true to crypto’s roots, it assumes users are comfortable with self-custodial tools like MetaMask, which is often untrue. Despite growing DeFi activity in Africa, Chainalysis data shows that most crypto value still flows through centralized platforms. By offering a swap interface, Zap inherently limits its reach. The company says it is working on adding non-custodial wallets to its product.

According to the co-founders, Zap has processed ₦20 billion (nearly $12.5 million) in transactions since launch and has more than 50,000 signups, with at least 12,000 active users monthly.

Zap’s ability to off-ramp crypto into Nigerian bank accounts before the CBN lifted its ban highlights the company’s deliberate approach to navigating regulatory complexity.

In 2021, the Central Bank of Nigeria (CBN) ordered banks not to engage with crypto services. That ban was only formally lifted in December 2023. However, Zap says it began processing fiat payouts to Nigerian bank accounts via APIs as early as 2022.

An operations staff member at a prominent Nigerian fintech told Mariblock that their company still restricts crypto-linked accounts one year after the ban was lifted.

Co-founder Moore Dagogo-Hart told Mariblock that Zap partnered with Benjamin Oyemonlan, CEO of Platnova, to secure a virtual asset service provider (VASP) license from the European Union. He said the permit enabled Zap to build APIs to facilitate payments. The company also maintains liquidity pools that make instant payouts possible.

“We didn’t really know how to attack the problem of regulation and working with banks. Initially, in the journey, we got Benjamin involved,” Dagogo-Hart said. “He was able to help us with his partnerships and his network to, for one, get the VASP license in Europe, and that really opened doors for us working with banks.”

Oyemonlan did not respond to Mariblock’s request for comment.

As for the trademark dispute with Paystack that recently brought Zap Africa into the spotlight, the company provided documents to Mariblock showing it applied for three trademark registrations with Nigeria’s Ministry of Industry, Trade, and Investment in 2023. It has since received approvals for two classes — 35 and 42 — and completed registration for a third, class 36, in April 2025. Paystack did not respond to Mariblock’s request for comment.

Zap Africa told Mariblock it intends to pursue legal action to protect its brand and assert exclusive rights to the name.