Welcome to Mariblock Weekly! Oge here with your weekly roundup of blockchain and digital asset updates.

Last week, Yellow Card announced it’s leaving retail behind to double down on B2B. We spoke to the team to understand the decision. South Africa’s Reserve Bank governor had strong views on how USD-backed stablecoins could undermine Africa’s monetary sovereignty.

📌 Don’t miss:

The Catch Up section for other stories you may have missed.

Let’s dive in!

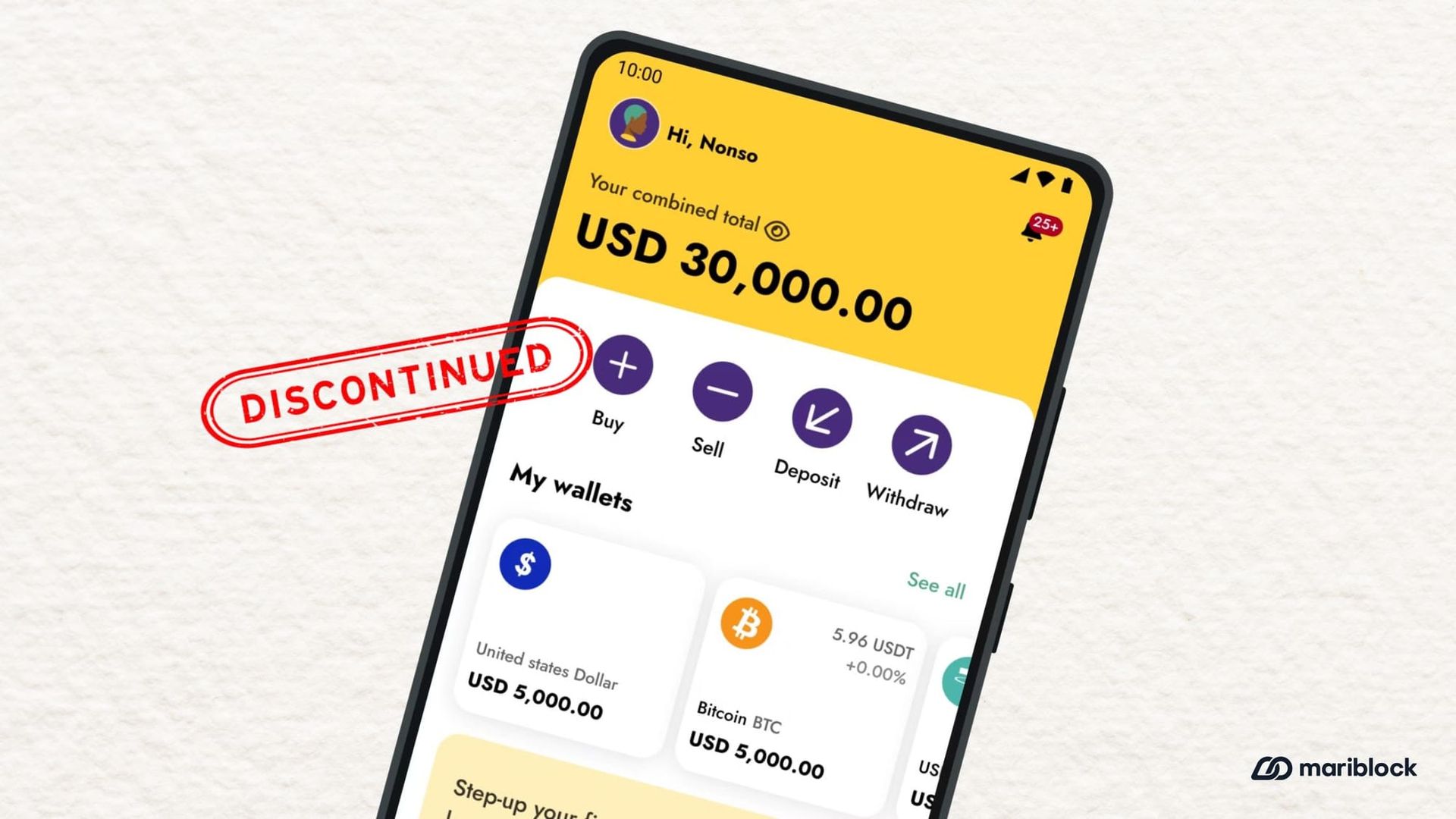

Why Yellow Card closed its retail business

Mariblock

Topline: Pan-African exchange and stablecoin platform Yellow Card is shutting down its retail app and discontinuing services for individual users as it pivots fully to B2B stablecoin payment infrastructure. (Details)

The details: In an October 29 email to users, Yellow Card described the move as a strategic shift toward providing enterprise-level stablecoin integration, custody, and settlement services for businesses in emerging markets.

- The company told Mariblock that the decision was driven by growing demand from businesses seeking reliable stablecoin-fiat payment rails.

- While no workforce changes have been announced, Yellow Card said it will eventually realign its staff to align with its new focus.

- Retail users have until December 31, 2025, to withdraw funds before the app closes on January 1, 2026.

Some context: Founded in 2019 by Chris Maurice, Yellow Card processed over $3 billion in transactions before deciding to pivot.

- Maurice said the retail business was costly to maintain with thin margins. The company is now focused on scaling its B2B infrastructure, combining legacy financial rails with stablecoins.

- Earlier this year, Visa partnered with Yellow Card to expand its stablecoin settlement network across Africa.

USD stablecoins can undermine African monetary sovereignty — SARB Governor

The South African Reserve Bank

Topline: South African Reserve Bank Governor Lesetja Kganyago isn’t convinced stablecoins are as “stable” as their name suggests. (Details)

He warned that the rising use of U.S. dollar-pegged stablecoins across Africa could weaken the continent’s monetary sovereignty and limit central banks’ ability to manage their economies.

The details: Kganyago said cryptocurrencies should be seen as assets, not currencies — a distinction he believes is key to how they’re regulated.

- He pointed out that most stablecoins are backed by U.S. Treasuries, which themselves are not immune to risk, and questioned how “safe” those reserves truly are.

- To address the growing use of digital assets, the South African Reserve Bank has built a framework to recognize stablecoins and other crypto assets as financial instruments. This, he said, allows regulators to monitor usage and protect consumers within South African borders.

- Still, he made it clear that the solution isn’t to ban crypto or stablecoins but to strengthen trust in local currencies through sound policy and better regulation.

What was said:

“I have a problem with the name ‘stablecoins’ because I am not sure that they are quite as stable as they are made out to be… At the moment, U.S. Treasuries are seen as safe assets [backing them], but there are questions about how safe is the safe asset.”

Some context: Between mid-2024 and mid-2025, over $200 billion in value moved on-chain across Africa, and nearly half of that came from stablecoin transactions, driven by users in Nigeria, Ghana, and Kenya.

- With the naira and cedi among the world’s weakest currencies in 2024–2025, stablecoins have become a lifeline for merchants and individuals seeking a more accessible route to USD.

Why it matters: Stablecoins are increasingly filling gaps left by local banking systems, but their popularity raises questions about who controls Africa’s financial future — local regulators or foreign-backed digital currencies.

Catch up

🇬🇭 Ghana Central Bank policy document calls for risk‑based regulation of virtual assets (Bitcoin.com)

🇳🇬 Nigerian lawmakers, crypto stakeholders push for balanced regulation (Techbuild)

That’s all for this week!

If you found this helpful, please consider sharing it with a friend or colleague or forwarding it online.

Till next week,

Ogechi.