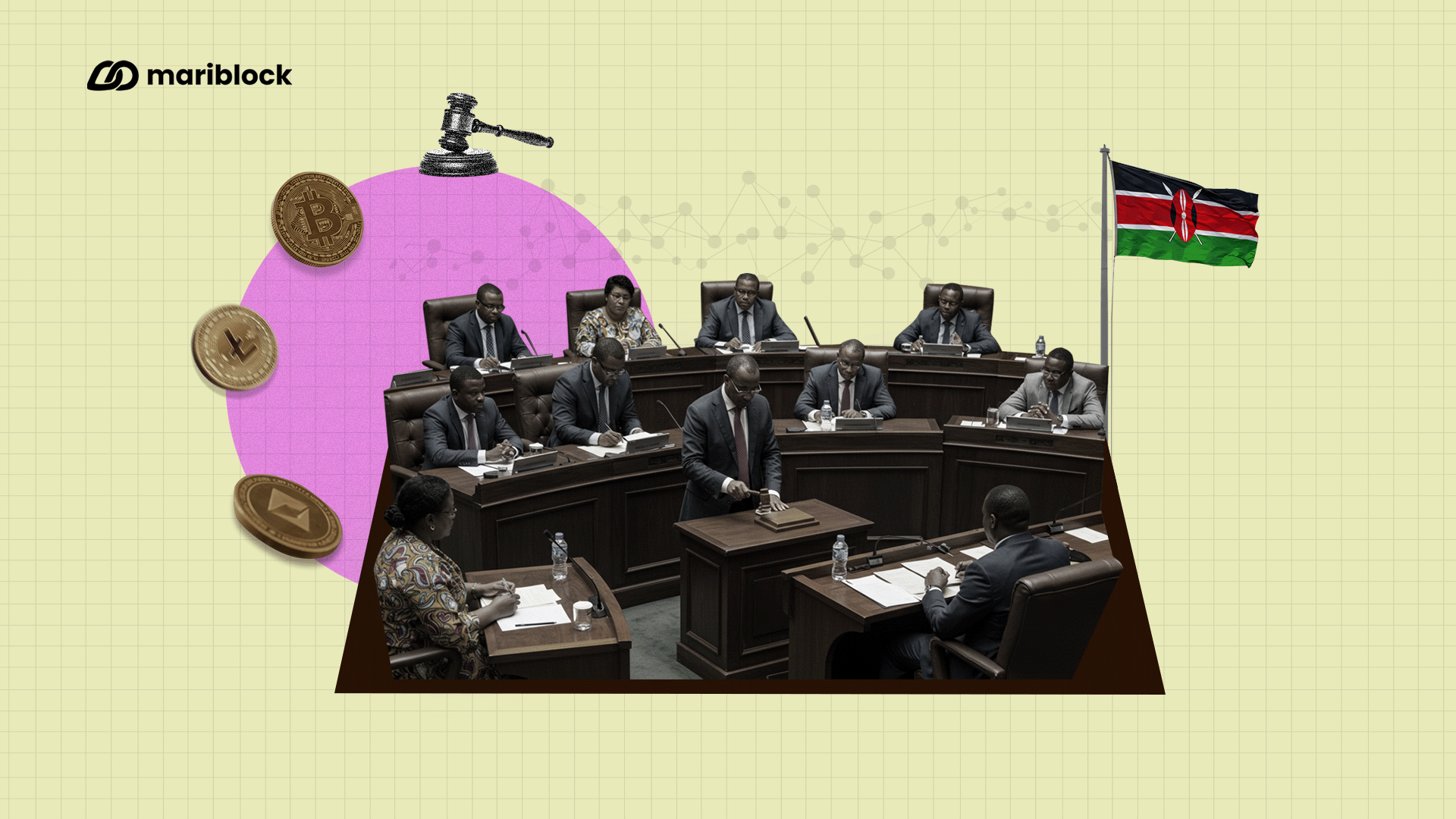

The Kenyan National Assembly has passed the Virtual Assets Service Providers Bill 2025, an act of parliament seeking to regulate digital assets and the activities of virtual assets service providers (VASPs) in Kenya.

The bill now awaits the Kenyan president’s official assent before it becomes enacted as an act of law.

The details

- According to reports, the draft bill is still under review, and changes are being made before its final version is released.

- It requires all Virtual Asset Service Providers (VASPs) operating in Kenya to obtain annual licenses from regulators.

- VASPs must also maintain a physical office in Kenya — operating without one would be considered illegal.

- The bill brings VASPs under Kenya’s Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) framework, requiring them to report transaction details above a specified threshold to authorities.

- Once enacted, VASPs will have one year to comply with the new rules. Failure to do so could result in license revocation or fines of up to KSh 25 million (about $194,000).

Stakeholder controversies

- The initial version of the bill proposed creating a new body, the Virtual Assets Regulatory Authority (VARA), to oversee Virtual Asset Service Providers (VASPs).

- This sparked controversy within Kenya’s crypto ecosystem, with critics arguing that VARA would favor larger firms over smaller players.

- A related clause required that the Virtual Assets Chamber of Commerce (VACC) — a crypto lobby group perceived to be aligned with Binance — have a seat on VARA’s board. Many industry stakeholders opposed this, citing potential bias and conflicts of interest.

- Others warned that establishing a new authority could duplicate regulatory efforts and delay enforcement.

- In response to these concerns, lawmakers have removed the clause from the latest draft and placed oversight of VASPs under the Capital Markets Authority (CMA) and the Central Bank of Kenya (CBK) instead.

Before now

- The VASP Bill 2025 was first brought before the Kenyan National Assembly on April 4.

- The bill had significant input from lobbyists in the country, emboldened by successes in prior engagements with the lawmakers, especially on the reversal of the digital asset tax (DAT) in the country.

- In April, Mariblock reported that players in the country’s crypto ecosystem had united to form a coalition to push against the implementation of the DAT.

- Shortly after, Kenyan authorities repealed the 3% digital asset tax provision, with legislators confirming that the actions of the Kenyan lobbyist coalition had a direct impact on the decision.